When it comes to running a business, there are a lot of moving parts. One of the most important aspects of your business is overall employee management. After all, if your employees don't feel valued, they won't stick around.

Ensuring that your employees get paid on time while in compliance is necessary for long-term success. Here are six essential tips for getting payroll compliance right.

This aspect of compliance is growing increasingly important as remote work grows across the globe. The legislation that applies to the country in which payroll is being processed may not align with the legislation where an employee is based. Taking extra training and learning about the upcoming changes is critical.

You must manage employee expectations regarding deductions. Create clearly outlined communications and policies regarding deductions, expenses, overtime, and anything else that could impact their pay.

For example, you might have one person in charge of entering new employees and another in charge of processing payments. As such, no one would be able to add a false employee with their banking information and push the payment through.

These internal measures protect the business and ensure that payroll practices are in compliance with legislation and the shareholders' interests.

The best way to get through an audit with minimal disruption is to create easy-to-follow audit trails. Audit trails create connections between purchases, transaction records, invoices, inventory, etc. Not only will this resource keep business moving forward when an audit occurs, but it also promotes accuracy and fraud prevention.

It's also common for some months or years to have an extra pay period. Staying ahead of upcoming deadlines will ensure the company doesn't get flagged for non-compliance.

Don't hesitate to reach out to a consultant specializing in payroll and compliance to help guide you along. Outsource to a chartered accountant to get advice on submitting taxes, finding discrepancies, and general knowledge about changing legislation.

When it comes to protecting your business and its employees, hiring a consultant to keep you moving in the right direction is well worth the investment.

If you feel overwhelmed by the idea of payroll compliance, you aren't alone. Having the right systems in place and the right experts on hand will help you immensely when navigating this confusing compliance journey.

Ensuring that your employees get paid on time while in compliance is necessary for long-term success. Here are six essential tips for getting payroll compliance right.

Keep Abreast of Payroll Legislation

As the world changes, so do the laws about how businesses operate. The best thing your business can do is stay abreast of payroll legislation changes and ensure that key players know what's required to stay in compliance.This aspect of compliance is growing increasingly important as remote work grows across the globe. The legislation that applies to the country in which payroll is being processed may not align with the legislation where an employee is based. Taking extra training and learning about the upcoming changes is critical.

Understand and Communicate Deductions

Deductions tend to be a point of confusion and miscommunication between employees and employers. They may vary from employee to employee and place to place. Some common deductions include local taxes, state taxes, social security taxes, insurance, and wage garnishment (source: What is Payroll? - HR Payroll Systems)You must manage employee expectations regarding deductions. Create clearly outlined communications and policies regarding deductions, expenses, overtime, and anything else that could impact their pay.

Limit Access and Authorization

Only a select few people need access to your payroll system and information. Ensure that checks and balances are put in place to limit access. Furthermore, there should be authorization checks within your program to prevent fraud.For example, you might have one person in charge of entering new employees and another in charge of processing payments. As such, no one would be able to add a false employee with their banking information and push the payment through.

These internal measures protect the business and ensure that payroll practices are in compliance with legislation and the shareholders' interests.

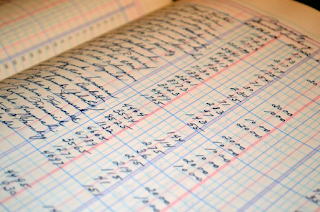

Create Audit Trails

The word "audit" is the stuff of nightmares for businesses, especially in the accounting department. However, as a business grows, audits aren't uncommon.The best way to get through an audit with minimal disruption is to create easy-to-follow audit trails. Audit trails create connections between purchases, transaction records, invoices, inventory, etc. Not only will this resource keep business moving forward when an audit occurs, but it also promotes accuracy and fraud prevention.

Stay Ahead of Deadlines

It's essential to be aware of upcoming deadlines and ensure the required work is done well in advance. In addition to regular payroll, there will be infrequent occurrences, such as tax deadlines and pension contribution matching periods.It's also common for some months or years to have an extra pay period. Staying ahead of upcoming deadlines will ensure the company doesn't get flagged for non-compliance.

Work with a Consultant

If you run a small business or startup, payroll and human resource management might be a foreign language to you. Even those who process payroll and work in accounting every day sometimes struggle with changes and new experiences in payroll.Don't hesitate to reach out to a consultant specializing in payroll and compliance to help guide you along. Outsource to a chartered accountant to get advice on submitting taxes, finding discrepancies, and general knowledge about changing legislation.

When it comes to protecting your business and its employees, hiring a consultant to keep you moving in the right direction is well worth the investment.

If you feel overwhelmed by the idea of payroll compliance, you aren't alone. Having the right systems in place and the right experts on hand will help you immensely when navigating this confusing compliance journey.